Wealth.com has built a comprehensive ecosystem to simplify the estate planning process while remaining dedicated to maintaining quality and rigor. We are proud to work closely with our advisor partners and their clients to provide the tools to create, visualize and manage their estate plans over time. Check out the newest releases below. We welcome any feedback or questions: support@wealth.com.

Share Files With Your Clients

To help organize important information for clients in one secure place, advisors are now able to upload and store files directly to their client’s Vault. With this functionality, advisors are now able to upload signed copies of their client’s estate planning documents and soon they will be able to confirm on their client’s behalf that their documents have been signed.

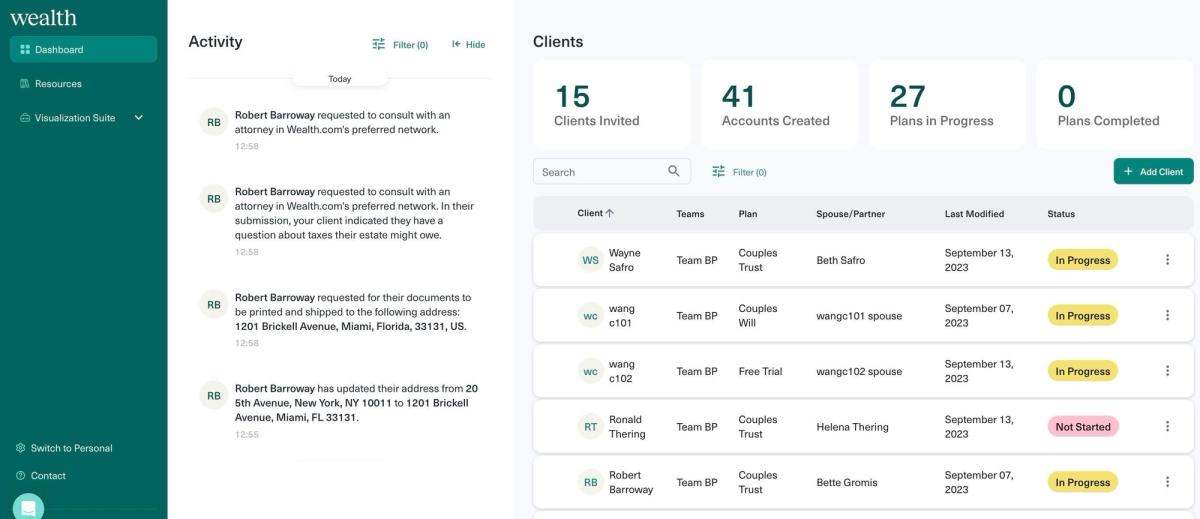

New Client Activity Updates

We continuously add new activity updates for our advisor partners to leverage to engage in thoughtful touch-points with clients. These updates provide advisors with ultimate transparency about their client’s Wealth.com account activity and progress in their estate planning journey.

- Client Changed Address: Advisors now receive an activity update when their client updates their address in-app. This activity update lets the advisor know the client’s latest address, as well as their previous address on file. Soon, this update will be paired with an insight for advisors to consider reaching out to their client to update their estate plan if it has already been drafted to ensure their documents reflect the laws of their current state of residence to ensure effectiveness and ease of administration.

- Client Requested to Consult an Attorney: Wealth.com offers a hybrid approach to the client experience, offering clients the ability to speak with an attorney in our preferred network. Now, when an advisor’s client requests to consult an attorney, we share that information back to their advisor and provide supporting information about their client’s request.

- Client Requested a Print & Shipment of Documents: Our advisor partners are now notified when their client requests to have copies of their documents printed and shipped. This update can be leveraged for our advisor partners to coordinate their client’s signing their documents and helps them to track their progress on completing their estate plan.

Document Enhancements

Customized Sub-Trusts for the Individual Revocable Trust: We’ve enhanced the ability for clients to better customize their documents to include sub-trusts, including a Marital Trust, Trust for Descendants, or a simpler Holdback Trust. As your client drafts their Individual Revocable Trust, their answers will help them to determine whether any of these sub-trusts should be included in their document. Please note that the ability to include a customized Marital Trust and/or Trust for Descendants is coming soon for the Joint Revocable Trust and Last Will & Testament.

Document Optimization Based on State Law Changes: We continuously update our documents to ensure they reflect the latest in state law. We updated our Financial Power of Attorney form based on changes to Vermont law to reflect the latest statutes.

We want to hear from you! Please share your feedback with us: support@wealth.com.