In case you missed it, our big news this month was that we have secured a $30 million Series A funding, led by GV (Google Ventures). This funding will allow us to invest into our people and product, ensuring that we continue to deliver features that truly revolutionize estate planning while supporting the entire advisor community.

We also released some exciting new features for both our core product as well as Family Office Suite™ including enhancements to Ester™, our AI extraction tool and a redesigned Report Builder.

Automatic contact card creation with Extractor by Ester™

Ester™, our AI legal assistant, allows you to upload existing client estate plans to get the key details of clients existing documents in minutes, saving you hours of manual review. Now, we’re introducing even more automation to save you time by automatically creating contact cards for key individuals identified in those documents, including trustees, executors, guardians and more.

For clients that plan to update their estate plans using wealth.com, these contact cards are accessible during their drafting workflow.

For advisors that have Family Office Suite™, the contacts created alongside the confirmed details of the client’s document will be pre-filled into Trust and Will Cards to instantaneously feed the information into visualizations accessible for reporting.

Redesigned visualizations and new educational slides in Report Builder

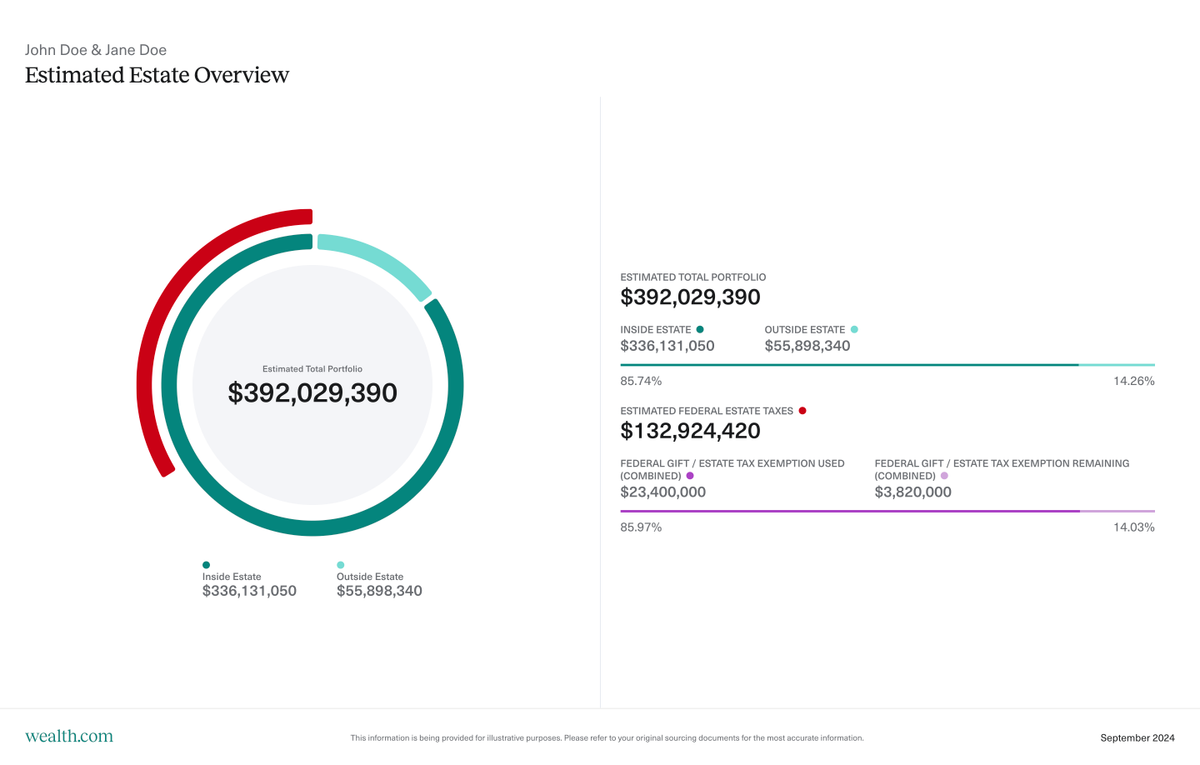

Our Family Office Suite™ gives advisors access to our suite of tools intended to visualize and uncover strategic planning opportunities for their clients with complex estates. The final deliverable comes together from the Report Builder, which allows you to build a personalized report to deliver to clients that details the estate, how assets will flow and potential strategies for reducing taxes.

Our reports now have a new, sleek look that provides a simpler aesthetic for clients to understand all aspects of their estate plans—without sacrificing quality. This redesign provides you an even better way to engage with their clients and to have productive conversations about their estates.

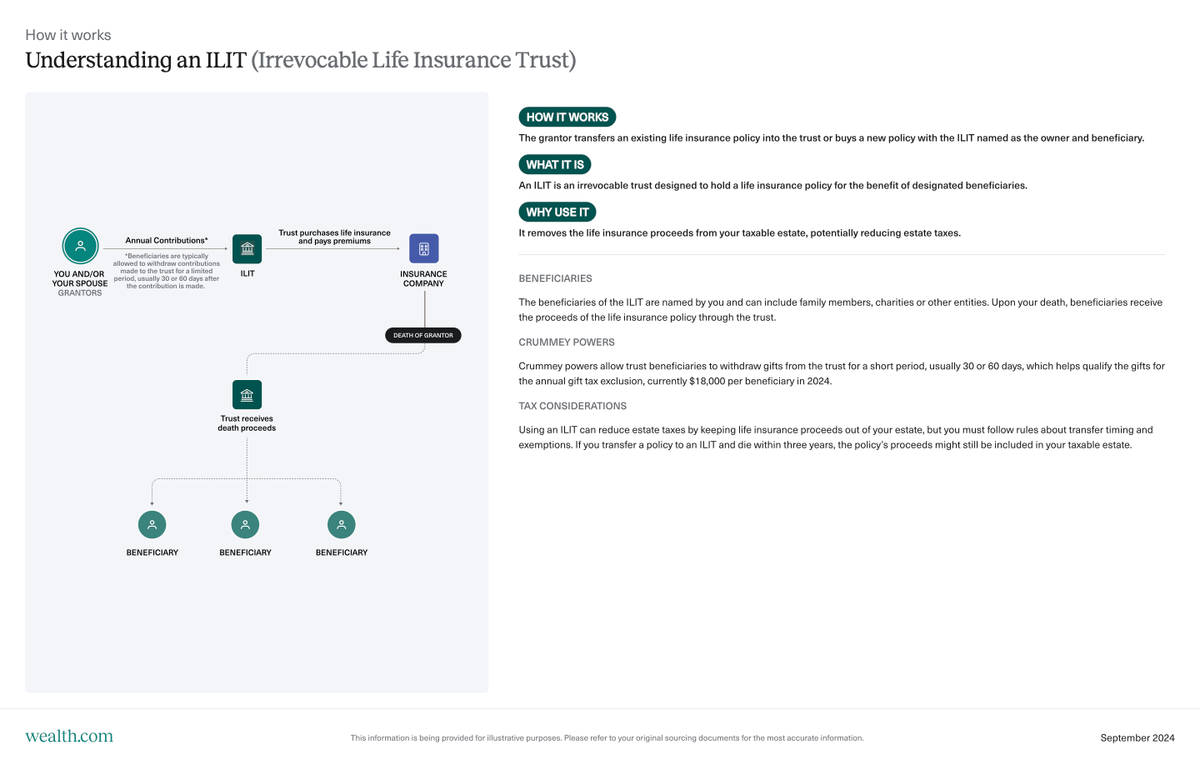

We’ve also introduced new educational slides that detail specific types of Irrevocable Trusts, including Grantor Retained Annuity Trusts (GRATs), Spousal Lifetime Access Trusts (SLATs), Qualified Personal Residence Trusts (QPRTs), Irrevocable Life Insurance Trusts (ILITs) and more.

These slides are intended to help you to provide subject-matter expertise directly to your clients to have more meaningful discussions with them about how these types of trusts are set up, their benefits, tax considerations and potential risks.

New Integrations with Charles Schwab

Our goal is to provide you with a seamless experience in our platform to drive scale and efficiency for your practice. That’s why we’re excited to announce that you are now able to pull asset and account information directly from Schwab.You can automatically set up your client’s balance sheets and rely on the most up-to-date details of their finances to streamline your planning process with them.

Document Enhancements: Updated Financial Power of Attorney documents

We continuously optimize our document creation offering to ensure that all of the documents available on our platform reflect any changes in federal or state legislation. We do this by partnering with local counsel in all 51 U.S. jurisdictions.

In partnership with local counsel in a number of states, including Arizona, Florida, Georgia, Ohio and Texas, we updated our Financial Power of Attorney documents.

We take pride in collaborating closely with our advisor partners and their clients to offer tools for creating, visualizing and managing estate plans effectively over time. Your feedback is invaluable to us, so please don’t hesitate to share your thoughts with us by emailing us at support@wealth.com.