We can't believe we’re more than halfway through 2024! It’s been a busy summer so far, and we’re excited to share the latest updates with you.

Introducing the Task Center to Elevate Oversight of Your Client’s Estate Planning Journey

You asked and we listened. We’re pleased to announce the Task Center to enhance collaboration and streamline estate planning oversight for advisors. Accessed through the Advisor Dashboard, advisors are able to add items—or tasks—for each of their clients to better track the progress of what’s done and what’s still outstanding.

Advisors can add tasks for each client to create a clear roadmap of what needs to be done, including tasks they need to complete themselves, as well as what their client needs to complete. For example, a task named “Onboarding Meeting” can be added to remind them to set a time with their client to walk through how to use wealth.com. They can also add a task to “Save documents to Vault” to remind their clients to upload their signed documents and other files that are essential for estate settlement, such as partnership certificates and stock agreements. Once complete, check the task off your list and it will be moved to the “Completed” row below.

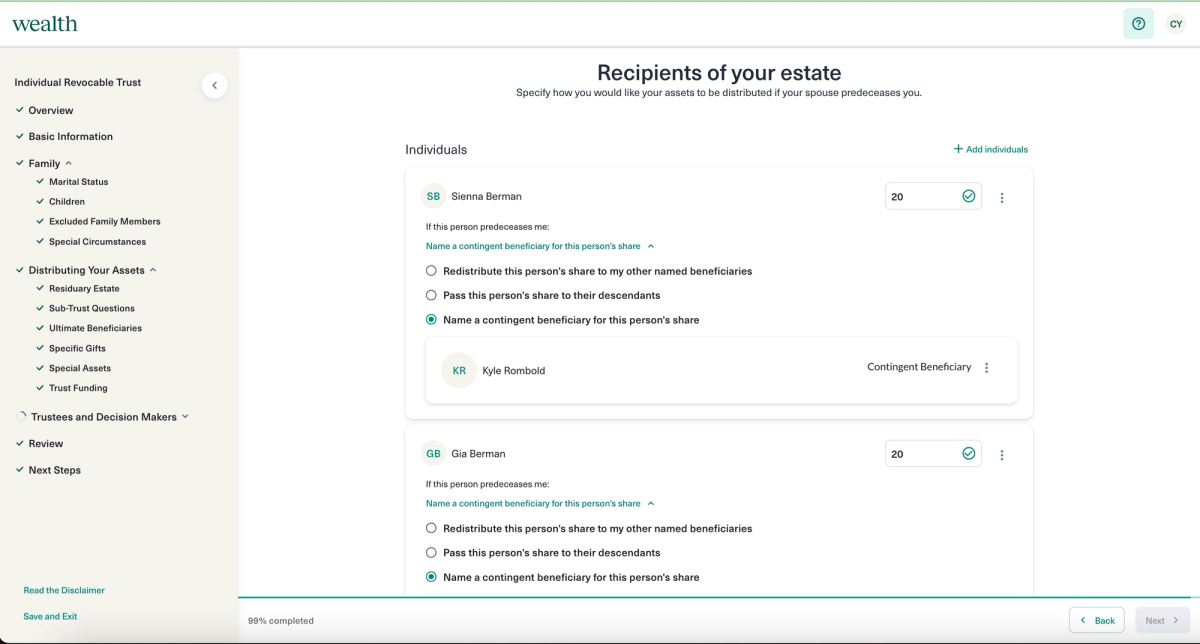

Document Update: Name Contingent & Ultimate Beneficiaries

Members are now able to name an alternate (or “contingent”) beneficiary to receive a share of their residuary estate or a specific gift in the event that the primary beneficiary they have named predeceases them, or if the beneficiary is a charity and no longer exists or has lost its charitable status from the IRS. Members also now have the option to name ultimate beneficiaries, which is more of a “catch-all” beneficiary who can take any assets (not just a specific share or gift) if that asset cannot be distributed.

How do contingent and ultimate beneficiaries work? In a typical plan, a contingent beneficiary might be a grandchild who was born to a specific child and who can only receive up to the share that the child could have received, whereas an ultimate beneficiary might be a charity who could receive any number of your assets in the event that none of your descendants survive (also known as a “disaster” clause).

These updates are available to members in their Joint Revocable Trust, Individual Revocable Trust, and Last Will & Testament document creation workflows.

In Case You Missed It: Family Office Suite™ & New Legal Hire

You’ve likely heard that we have released our Family Office Suite™ earlier this month, a collection of new and existing features to streamline estate management for highly complex estates.

If you haven’t, or would like to learn more, you can join our upcoming webinar on August 6 at 1pm PT | 4pm ET where we’ll be diving deep into the features.

We also announced our latest hire, David Haughton, who joined as our senior corporate counsel. Haughton comes from Commonwealth Financial Network where he was responsible for providing estate, trust, charitable, education, business and social security planning support to the firm's affiliated advisors. Prior to that, he was in private practice as an attorney.

He has a passion for estate planning and will be instrumental in the development of our products, ensuring the high quality that our advisors expect.

We take pride in collaborating closely with our advisor partners and their clients to offer tools for creating, visualizing, and managing estate plans effectively over time. Your feedback is invaluable to us, so please don’t hesitate to share your thoughts by emailing us at support@wealth.com